September 14, 2021 - Bedford, NS - (TSXV:SSE) - Silver Spruce Resources, Inc. ("Silver Spruce" or the "Company") is pleased to announce that it has signed a Definitive Agreement with two parties (the “Vendors”) to acquire 100% of three early-stage gold exploration properties, Mystery, Till and Marilyn, (the “Property” or the “Properties”) located near Grand Falls, Newfoundland, Canada, 20-25 kilometres west of New Found Gold Corp.’s Queensway project and 15-35 kilometres south of Sokoman Minerals Corp.’s Moosehead gold project.

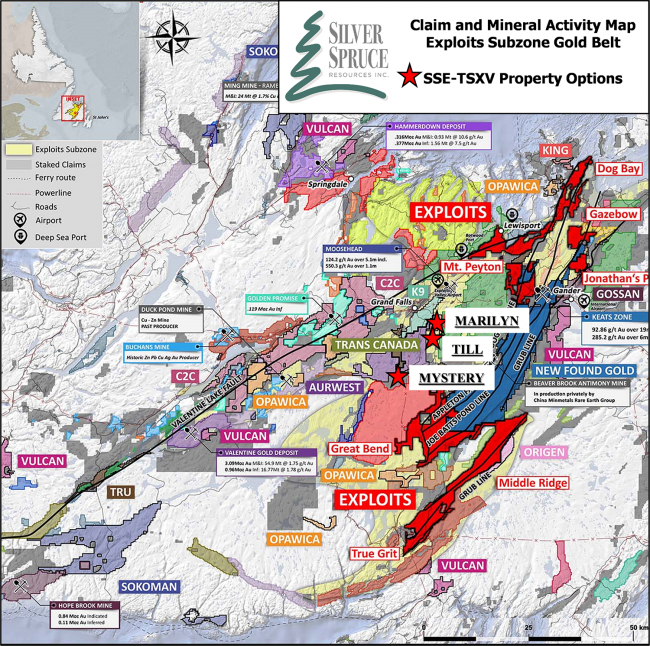

Figure 1. Location Map of Mystery, Till and Marilyn Gold Properties in the Exploits Subzone Gold Belt (Image adapted from exploits.gold).

“We expedited our initial site visit on the Properties during the week of August 23rd and given the positive initial report on the mineral and rock textures potentially related to shallow epithermal and/or orogenic vein-style mineralization, we are pleased to move forward with this Definitive Agreement with the Vendors,” said Greg Davison, Silver Spruce VP Exploration and Director. “We believe that this is a timely opportunity to acquire these Properties given their strategic location in a very active exploration camp, displaying prospective geology with only limited exploration and no history of drilling, and proximal to regional and secondary structural features defined by the geophysical and geological coverage. We have started building out the project ArcGIS database and investigating the most up-to-date and appropriate geochemical and geophysical techniques to conduct a Fall 2021 Phase 1 exploration program.”

The Properties are well situated in exploration logistics, located close to each other and <10-25 kilometres southeast and south by road from Grand Falls, Newfoundland. The Properties are located <50 kilometres from the Gander International Airport and are easily accessible from major paved roads and local logging and bush roads and trails largely by vehicles and more remote areas by ATV.

The 8,750-hectare project is located within the Exploits Subzone, an extensive area of mineral exploration activity and discoveries over the past two years (Figure 1). The region is structurally complex and located, in large part, between two major crustal lineaments, the Grub Line and Valentine Lake Faults. Numerous major to lesser sub-parallel features merge and bifurcate along strike and are transected by NW and EW-trending faults. These deep-seated structures, which juxtapose geological terranes over hundreds of kilometres, are key to the location and formation of orogenic gold deposits containing several million ounces of gold as reported by a number of junior companies in the district. Though younger, the lineaments are very similar to those of the Abitibi Gold Belt in Ontario and Quebec in scale, splaying surface expression and wide distribution of mineral endowment, though in an earlier stage of overall exploration and development.

“We look forward to working in Newfoundland which offers a favorable regulatory environment, supportive communities, outstanding provincial geological survey, near year-round operating conditions, excellent property access and of principal importance, significant potential for new deposits as indicated by the number and quality of recent successful exploration projects,” said Greg Davison, Silver Spruce VP Exploration and Director. “The Company’s decision to add multiple properties to our portfolio in high-quality jurisdictions will give shareholders more opportunities for notable discoveries.”

Due Diligence

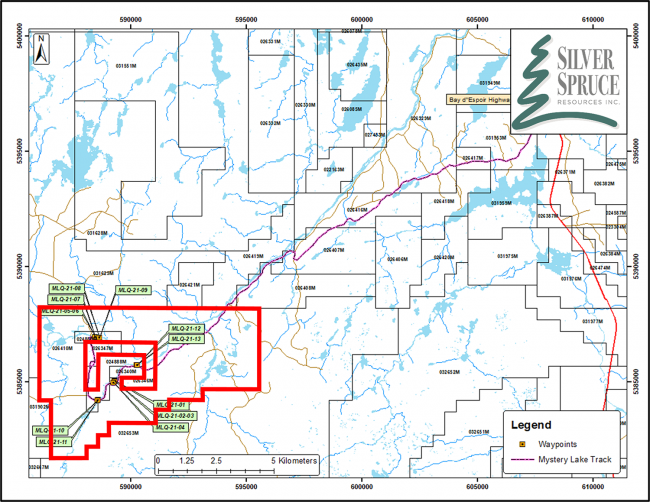

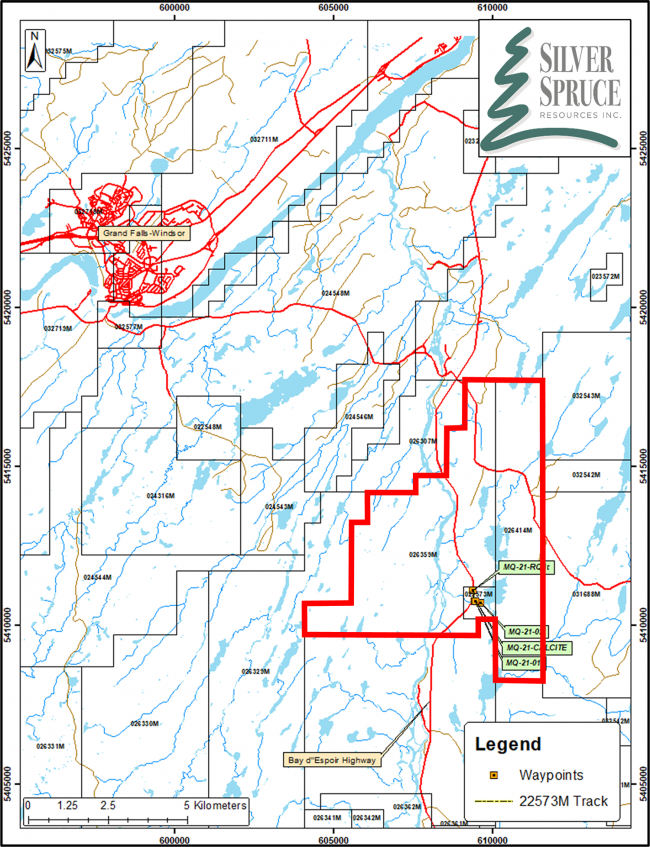

Silver Spruce contracted a Newfoundland-based professional geologist to visit the properties with one of the Vendors. They travelled to the Mystery and Marilyn properties, shown in Figures 2 and 3 respectively, examined the geology, verified sample locations for the historical assays and collected new rock samples, thirteen of which were submitted to ALS Global for analysis, and took photographs of pertinent topography, geomorphology, geological exposures, access and types of vegetation. The four claims on the Till property were not evaluated during the site visit. Additional rock samples and splits of assay samples were shipped by courier to the Company’s QP for forthcoming examination by optical microscopy. The results of the due diligence rock geochemistry for thirteen samples are expected from ALS Global in due course.

Figure 2. Mystery claims transected by the Great Rattling Brook. Due diligence sampling sites indicated.

Figure 3. Marilyn claims, southeast of Grand Falls, transected by the Bay d’Espoir Highway. Due diligence sampling sites indicated.

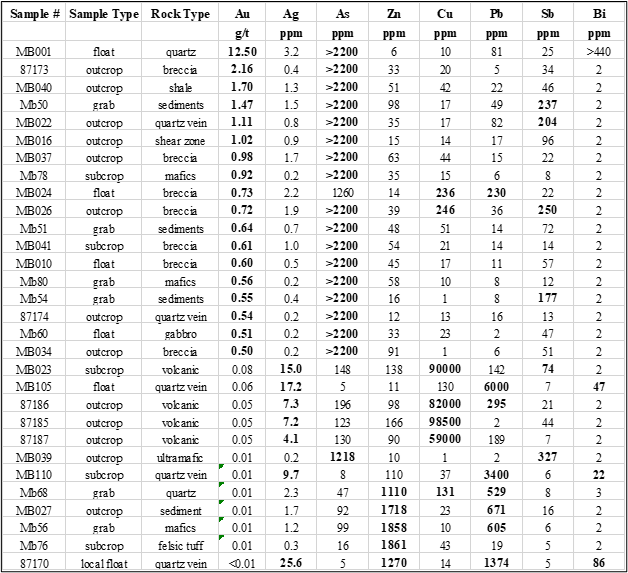

A selection of historical assays reported for precious and base metals and pathfinder elements from 123 samples collected from Mystery and Marilyn are shown in Table 1. Eighteen samples reported Au >0.5 g/t (max. 12.5 g/t Au). Cu values were reported up to to 9.85% with minor Ag, Pb and Zn. Arsenic was highly anomalous with values for 36 samples over the 2200 ppm upper limit for Inductively Coupled Plasma (ICP-OES) analysis, strongly associated with elevated Au values and displayed generally as minor to abundant arsenopyrite (see Figure 4).

Table 1. Select analyses from historical exploration on the Mystery and Marilyn properties – n=123 The samples represent those with Au, Ag and base metal (Cu, Pb, Zn) values in the 90th percentiles for each element from a total of 123 samples analysed.

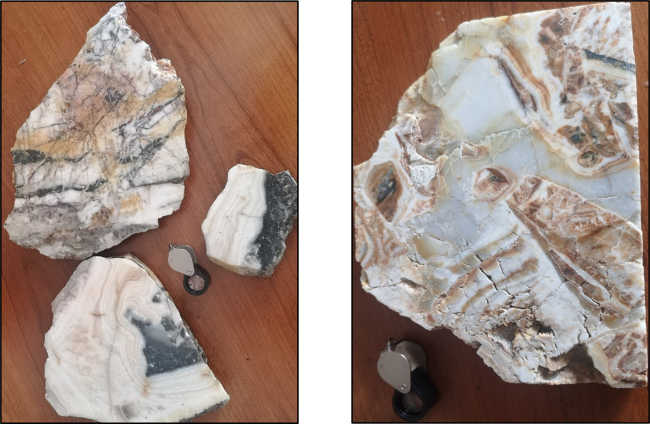

Multiple surface occurrences are reported of agate chalcedony to colloform and crystalline silica veining and multi-phase breccias (see Figures 4 and 5), carbonate replacement by quartz, and open-space filling quartz and calcite, all textures indicative of the upper zones of epithermal systems and epizonal to mesozonal structural conduits in orogenic systems, and are accompanied by Au and arsenopyrite, stibnite, chalcopyrite, bornite and Cu carbonate mineralization in several host lithologies including quartz, black shale and other sediments, ultramafics and gabbro.

Figure 4. Left - Epithermal silica veining outcropping along Great Rattling Brook. Right - Quartz float with arsenopyrite, sample grade reported as 12.5 g/t Au, 3.2 g/t Ag with anomalous As and Bi.

Figure 5. Polished samples showing epithermal chalcedonic silica veining with complex depositional and compositional banding, open space filling and multi-stage brecciation from Mystery property.

Terms of Agreement

Silver Spruce had a 30-day window after signing the LOI (see Press Release August 16th, 2021) to carry out its due diligence and prepare a Definitive Agreement (“DA”) for the Property acquisition.

The principal terms to purchase 100% interest in the Properties include cash payments and Silver Spruce common shares, with CAD$40,000 in cash and 1,000,000 shares on signing, and escalating payments of CAD$575,000 and 9,000,000 shares spread over five years on the anniversary date of TSX Venture Exchange approval. The minimum work expenditures over the life of the agreement total CAD$1,500,000. All financial terms are in Canadian dollars.

A finder’s fee is payable on the acquisition pursuant to the guidelines of the TSX Venture Exchange.

Upon TSX acceptance for the DA, Silver Spruce will earn a 100% interest in the Property by paying the following cash payments to the Vendors or their nominee(s):

- $40,000 collectively upon receipt by the Purchaser of the Conditional Acceptance of the Exchange of this Agreement;

- $50,000 collectively upon the first anniversary of the date of the Final Exchange Bulletin;

- $75,000 collectively upon the second anniversary of the date of the Final Exchange Bulletin;

- $100,000 collectively upon the third anniversary of the date of the Final Exchange Bulletin;

- $150,000 collectively upon the fourth anniversary of the date of the Final Exchange Bulletin;

- $200,000 collectively upon the fifth anniversary of the date of the Final Exchange Bulletin; and

issuing to the Vendors or their nominee(s) from treasury the following Shares:

- 1,000,000 common shares collectively upon receipt by the Purchaser of the Conditional Acceptance of the Exchange of this Agreement;

- 1,000,000 common shares collectively upon the first anniversary of the date of the Final Exchange Bulletin;

- 1,250,000 common shares collectively upon the second anniversary of the date of the Final Exchange Bulletin;

- 1,500,000 common shares collectively upon the third anniversary of the date of the Final Exchange Bulletin;

- 2,000,000 common shares collectively upon the fourth anniversary of the date of the Final Exchange Bulletin;

- 3,250,000 common shares collectively upon the fifth anniversary of the date of the Final Exchange Bulletin; and

incurring a minimum of $1,500,000 in Expenditures on the Property as follows:

- $150,000 in property expenditures by the first anniversary of the date of the Final Exchange Bulletin; and

- $200,000 in additional property expenditures by the second anniversary of the date of the Final Exchange Bulletin; and

- $250,000 in additional property expenditures by the third anniversary of the date of the Final Exchange Bulletin; and

- $300,000 in additional property expenditures by the fourth anniversary of the date of the Final Exchange Bulletin; and

- $600,000 in additional property expenditures by the fifth anniversary of the date of the Final Exchange Bulletin.

Upon completion of the above terms in to earn a 100% interest in the Property, and the Title Transfer, the Vendors will reserve, retain and hold a 2% net smelter return royalty as described in the Royalty Agreement (the “Royalty”).

An advance payment against the Royalty payable by the Purchaser to the Vendors in the amount of $15,000 will be made on an annual basis starting on the 6th anniversary of the date of the Final Exchange Bulletin.

The Company shall be entitled, at any time in its sole discretion, upon written notice to the Vendors, to buy back 1% of the Royalty for $2,000,000, and shall have the right to buy back the remaining 1% of the Royalty from the Vendors at any time at a prevailing market price.

Geochemical Analysis, Quality Assurance and Quality Control

Rock samples were collected, packaged and delivered by the Company’s contract professional geologist to a courier service for shipment to the ALS sample preparation facility in North Vancouver, British Columbia, Canada. ALS Global is a facility certified as ISO 9001:2008 and accredited to ISO/IEC 17025:2005 from the Standards Council of Canada.

Pulps (50gram split) were submitted for Au analysis by Fire Assay with Atomic Absorption finish (Au-AA24) and Four Acid Digestion with Inductively Coupled Plasma Atomic Emission Spectrometry (ICP-AES) multi-element analyses (ME-ICP61m).

Given the small size of the sample suite, no additional in-house quality control samples (blanks, standards, duplicates, preparation duplicates) were inserted into the sample set. ALS Global conducts its own internal QA/QC program of blanks, standards and duplicates, and the results are provided with the Company sample certificates. The results of the ALS control samples will be reviewed by the Company's QP and evaluated for acceptable tolerances. All sample and pulp rejects will be stored at ALS Global pending full review of the analytical data, and future selection of pulps for independent third-party check analyses, as requisite.

All of the metal values disclosed herein for the Mystery and Marilyn properties by past operators, including the Vendors, and by Silver Spruce are reported from grab samples which may not be representative of the metal grades, or the metal grade distribution, and those from previous exploration efforts must be considered as historical in nature. The Company has reviewed the historical certificates, where available, and conducted data verification sampling on the known areas of mineralization with a view to to confirm the presence and tenor of metal values. The verification sample results are pending from ALS.

The Company believes that the analytical protocols and data will withstand scrutiny for inclusion. Sample grades reported by element in the technical documentation and analytical certificates range from detection limit (based on the specific instrumentation and by element) to anomalous values which represent and include select samples and are reported as ‘up to’ the maximum values and/or ranges presented. Average values may be reported for select suites of samples in which the sample frequency is indicated and which only represent metal grades from those samples.

Qualified Person

Greg Davison, PGeo, Silver Spruce VP Exploration and Director, is the Company's internal Qualified Person for the Mystery, Marilyn and Till Projects and is responsible for approval of the technical content of this press release within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects ("N.I. 43-101"), under TSX guidelines.

About Silver Spruce Resources Inc.

Silver Spruce Resources Inc. is a Canadian junior exploration company which has signed Definitive Agreements to acquire 100% of the Melchett Lake Zn-Au-Ag project in northern Ontario, and with Colibri Resource Corp. in Sonora, Mexico, to acquire 50% interest in Yaque Minerales S.A de C.V. holding the El Mezquite Au project, a drill-ready precious metal project, and up to 50% interest in each of Colibri's early stage Jackie Au and Diamante Au-Ag projects, with the three properties located from 5 kilometres to 15 kilometres northwest from Minera Alamos' Nicho deposit, respectively. The Company also is acquiring 100% interest in the drill-ready and fully permitted Pino de Plata Ag project, located 15 kilometres west of Coeur Mining's Palmarejo Mine, in western Chihuahua, Mexico. Silver Spruce has signed a Definitive Agreement to acquire 100% interest in three exploration properties in the Exploits Subzone Gold Belt, located 15-40 kilometres from recent discoveries by Sokoman Minerals Corp. and New Found Gold Corp., central Newfoundland. Silver Spruce Resources Inc. continues to investigate opportunities that Management has identified or that have been presented to the Company for consideration.

Contact:

Silver Spruce Resources Inc.

Greg Davison, PGeo, Vice-President Exploration and Director

(250) 521-0444

gdavison@silverspruceresources.com

Michael Kinley, CEO and Director

(902) 826-1579

mkinley@silverspruceresources.com

info@silverspruceresources.com

www.silverspruceresources.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Notice Regarding Forward-Looking Statements

This news release contains "forward-looking statements," Statements in this press release which are not purely historical are forward-looking statements and include any statements regarding beliefs, plans, expectations or intentions regarding the future, including but not limited to, statements regarding the private placement.

Actual results could differ from those projected in any forward-looking statements due to numerous factors. Such factors include, among others, the inherent uncertainties associated with mineral exploration and difficulties associated with obtaining financing on acceptable terms. We are not in control of metals prices and these could vary to make development uneconomic. These forward-looking statements are made as of the date of this news release, and we assume no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward-looking statements. Although we believe that the beliefs, plans, expectations and intentions contained in this press release are reasonable, there can be no assurance that such beliefs, plans, expectations or intentions will prove to be accurate.