April 12, 2021 - Bedford, NS - (TSXV:SSE) - Silver Spruce Resources, Inc. ("Silver Spruce" or the "Company") is pleased to announce the signing of a Letter of Intent with Colibri Resource Corp. (TSXV:CBI) (“Colibri”), and its wholly-owned Mexican subsidiary, Yaque Minerales SA de CV (“Yaque”), to acquire up to 50% interest in four concessions comprising two properties, Diamante 1 and Diamante 2, with a cumulative land position of 1,057 hectares.

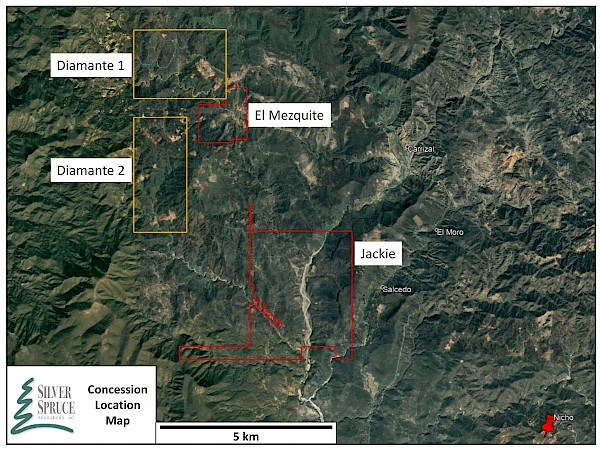

The Diamante gold-silver (Au-Ag) project (“Diamante” or the Property”) is a drill-ready precious metal property located 5 km northwest of the town of Tepoca, and 165 km southeast of the capital city of Hermosillo, eastern Sonora, Mexico. Diamante 1 is situated to the west of Silver Spruce’s 180-ha El Mezquite project. Diamante 2, 700 metres south of Diamante 1, is located 1.6 kilometres northwest of the Company’s 1,130-ha Jackie project (Figure 1).

"We are excited to acquire an interest in a large property with the outstanding potential of Diamante adjacent to our prospective El Mezquite and Jackie projects,” said Greg Davison, Silver Spruce VP Exploration and Director. “At Diamante, historical high-grade Au-Ag and Pb-Zn-Cu assay data from small-scale workings and dumps, and recent exploration activities, provide an excellent starting point for discoveries in several diverse geological settings. Diamante offers strong precious metal tenor with a polymetallic endowment similar to the Company’s Pino de Plata project, and both contain multiple quality targets, limited artisanal mining with production, and no record of drilling.”

Diamante has been explored to a modest degree by modern exploration methods and there is significant evidence of historical hand surface and underground mining, and placer activities in stream channels and terraces on the project though no records of historical production or drilling are known.

“We recently conducted our due diligence visit to Diamante and, pending the final report, anticipate signing a definitive agreement shortly. On execution, we propose to conduct ground truthing of the Au-Ag systems with geological, spectral and LiDAR mapping, rock sampling and preparation of an environmental report, and are planning for a first-ever drilling program at Diamante within a few months. This provides the Company with another exceptional opportunity to grow with the strong gold and silver markets,” stated Mr. Davison. “The earn-in would require Silver Spruce to conduct an initial 2,000 metre diamond drill program to test first priority targets defined by the Phase 1 exploration program.”

The acquisition would nearly double the Company’s land holdings in this prospective area to 2,367 hectares thereby providing exploration and drilling synergies. The adjacent El Mezquite and Jackie projects are currently subject to option agreements with Colibri wherein SSE can earn 50% of the gold and silver projects by meeting certain criteria over four years and two years, respectively. El Mezquite and Jackie currently have assays pending from Phase 1 mapping and prospecting while we await our Informe Preventivo for El Mezquite’s

maiden drilling program.

Figure 1. Diamante 1 and 2 Concession Location Map. Note adjacent El Mezquite and Jackie Concessions. Nicho mine development by Minera Alamos located 12 km SE of Diamante.

Location, Regional Geology, Mining and Exploration

The Property is very well situated in terms of logistics for exploration, adjacent to and west of the El Mezquite and Jackie properties, and is located twelve to fifteen kilometres west and northwest of the Nicho deposit currently under mine development by Minera Alamos (Figure 1). The Property is easily accessible from Mexican Highway #16 which transects Diamante 1 and on ranch trails and dry river beds to Diamante 2. High voltage power lines are positioned along Highway #16.

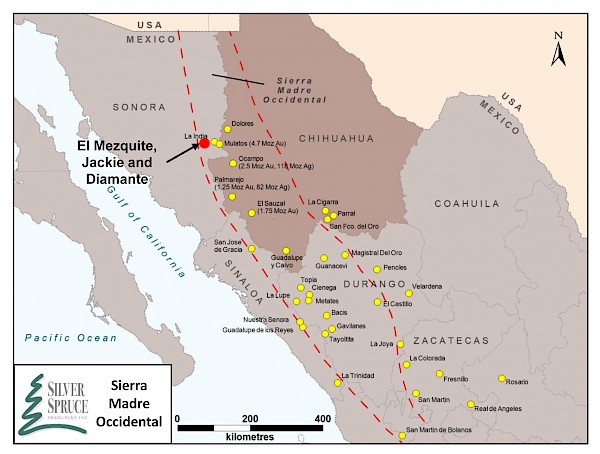

The Property is located within the west-central portion of the Sierra Madre Occidental Volcanic Complex within the prominent northwest-trending “Sonora Gold Belt” of northern Mexico and parallel to the well-known, precious metals-rich Mojave-Sonora Megashear (Figure 2).

Several nearby large operating mines include Alamos Gold’s Los Mulatos gold mine and Agnico Eagle’s La India gold mine located 50 and 58 km to the northeast, respectively, Agnico’s Pinos Altos Mine, 100 km southeast and Argonaut’s La Colorada Mine, 100 km west. Exploration in the surrounding area is very active with adjacent and nearby properties held by Evrim, Newmont, Garibaldi, Kootenay Silver and Penoles.

The Sonora-Chihuahua area of the belt contains many other epithermal Au-Ag deposits such as Dolores, Ocampo, Palmarejo and El Sauzal which host more than 20 million ounces of gold-equivalent. Parallel to this trend, there are Cu-Mo-Au porphyry deposits such as Porphyry 4 Hermanos and Cerro Verde.

Figure 2. Location Map of Diamante, El Mezquite and Jackie Properties and Mines of the Sierra Madre Occidental

Property Geology and Mineralization

The Diamante Project exhibits geological characteristics of epithermal low to intermediate sulfidation Ag-Au (Pb-Zn), high sulfidation Au-Cu, and potential transition zones within and peripheral to porphyry style Au-Cu at depth.

The known sulphide mineralization includes galena, sphalerite, pyrite and chalcopyrite with secondary oxidation minerals such as copper carbonate (malachite) and copper sulphates with jarosite, hematite, goethite and limonite.

The Property hosts a variety of styles of precious and base metal polymetallic mineralization including disseminated, stockwork and vein hosted accompanied by alteration including silicification (with quartz veining), and phyllic, argillic, advanced argillic (quartz-alunite-pyrite) and propylitic (chlorite) zones, with near-surface overprinting by oxidation (goethite-hematite), jarosite and vuggy silica.

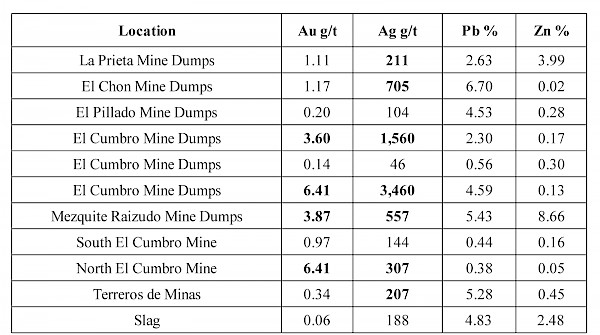

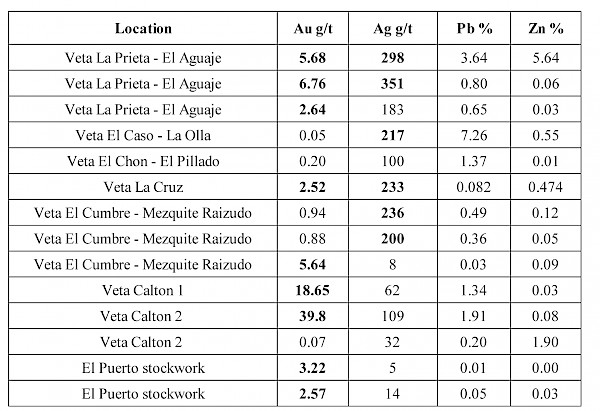

Sampling highlights from the ten known areas of interest on the Diamante concessions, some with artisanal mining, have reported significant values of precious and base metals (Au, Ag, Pb, Zn) in individual samples as follows (Tables 1 and 2) and as shown within the enclosed maps (Figures 3 and 4). Table 1 highlights samples collected from historical mine dumps and a small-scale processing slag. Table 2 illustrates the assays from vein (veta) and stockwork style mineralization.

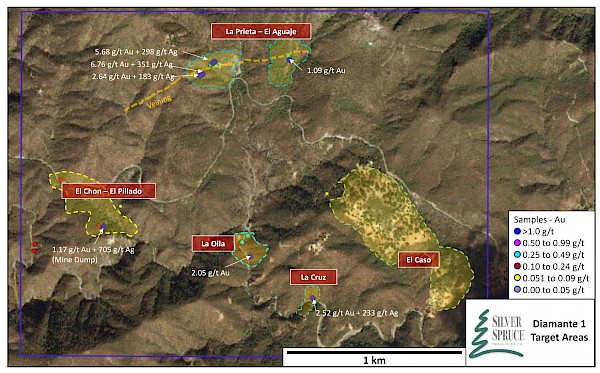

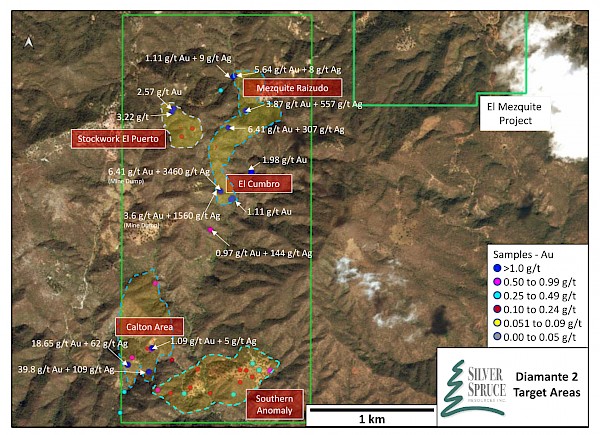

Diamante 1 includes known occurrences at La Prieta-El Aguaje, El Chon-El Pillado, La Olla, La Cruz and El Caso. Diamante 2 has targets reported at Mezquite Raizudo, El Puerto, El Cumbro, Calton and the Southern Anomaly.

Table 1. Selected historical assays on rock chip samples from mine dumps and process slag

Table 2. Selected historical assays on rock chip and channel samples from vein and stockwork settings

Mineralization commonly is coincident with alteration, veining and structural lineaments identified in the historical exploration. Six known vein systems correspond to ENE, NE and NW orientations.

All of the metal values disclosed herein were reported by past operators in the Diamante area, from grab, channel and dump samples which may not be representative of the metal grades, and must be considered as historical in nature.

Key Exploration Targets

Diamante 1

Figure 3 identifies the six principal targets currently known on Diamante 1 with a Phase 1 program expected to focus on La Prieta/El Aguaje and El Chon/El Pillado.

Figure 3. Diamante 1 with exploration targets noting gold and silver assays

La Prieta/El Aguaje

The vein system consists of a shear and fissure-filling zone exposed in short intervals (< 20 metres) over a strike length estimated at 2,000 metres. The veins have an ENE orientation and dip from 50 to 60 degrees to the north and northwest, and display widths of 0.40 metres to 1.20 metres with an average estimated at 1 metre. Sample grade up to 6.76 g/t Au, 351 g/t Ag, and 0.8% Pb over 1.1 metres.

Diamante 2

Calton

The “Calton 1” vein is interpreted to occur intermittently over a strike length of 1,100 metres with thicknesses or widths ranging from 0.30 metres to 1.5 metres. Mineralization consists of galena, sphalerite and coarse pyrite hosted with quartz and extensive iron oxides. Samples returned values up to 18.65 g/t Au and 62 g/t Ag over 1 metre. The Calton 2 vein is exposed in several discontinuous outcrops over a strike length of 900 metres with widths ranging from 0.30 metres to 1.70 metres. Samples report up to 39.8 g/t Au with 109.5 g/t Ag and 1.91% Pb over 0.42 metres.

Figure 4 identifies the five principal targets currently known on Diamante 2 with a Phase 1 program expected to focus on Calton, El Cumbro and Mezquite/Raizudo.

Figure 4. Diamante 2 with exploration targets noting gold and silver values

El Cumbro/Mezquite Raizudo

The El Cumbro-Mezquite Raizudo veins located in the northern part of Diamante 2 consists of fissure-filling quartz with sulphide mineralization of galena and sphalerite. The veins follow a northwesterly structural trend observed over an inferred strike length of 900 metres with widths reported from several centimetres to 1.5 meters with an average estimated width of approximately 1 metre. Samples report up to 5.68 g/t Au and 298 g/t Ag over 1.0 metre.

Terms of Agreement

Upon execution of a Definitive Agreement and acceptance by the Toronto Stock Exchange (TSX), to earn its initial 25% interest in the Property, Silver Spruce agrees to pay Colibri an initial cash amount of $75,000 USD directed to the Vendor’s $100,000 USD initial property payment whereupon Silver Spruce and Yaque each will hold a 25% interest in the Property and manage the Property as equal partners (“Partners”). Silver Spruce will be the designated operator of the Property during the earn-in period with the Vendor.

To earn its initial 50% of the Diamante project, Silver Spruce and Yaque also agree to design, permit and drill a minimum of 2,000 metres on the Property within 24 months from the Execution Date of Yaque’s final agreement with the Vendor; including any requisite exploration leading to the drill program, submit a final drilling report to meet NI 43-101 reporting guidelines and pay approved exploration costs at a ratio of Silver Spruce (75%) and Yaque (25%). The Partners will pay to the Vendor 50% of the bi-annual property taxes and surface rights payments.

Upon completion of the initial earn-in, Silver Spruce and Yaque will become equal joint venture partners with the Vendor in BIMCOL, a private Mexico company holding the concessions, pay to the Vendor 50% of the bi-annual property taxes and surface rights payments and pay approved prorata exploration costs at a ratio of Silver Spruce (50%) and Yaque (50%).

Yaque will have an exclusive period of six months to purchase the remaining 50% of BIMCOL by paying the Vendor either of: i) US$2.1 million or ii) US$1.45 million and the grant of a 2% net smelter royalty (NSR) on the project. Should Yaque elect to exercise its right to purchase the remaining 50% of BIMCOL, Yaque will also grant Silver Spruce the option to purchase one-half of its additional ownership for one-half of the cost for a period not to exceed six (6) months from the date Yaque elects to exercise its right.

Due Diligence

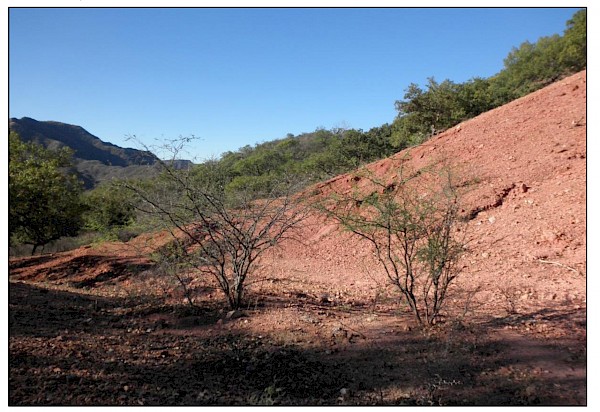

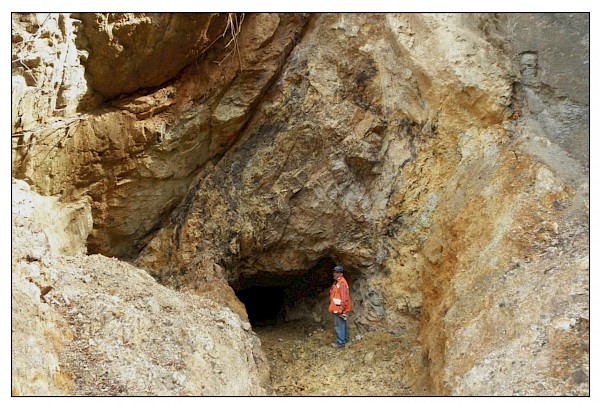

Last month, Silver Spruce sent a team of two geologists to the Diamante Concessions to verify the known targets (see Figures 5 and 6), and carry out preliminary sampling at Calton, El Cumbro, El Cazo-La Olla, La Prieta and El Chon. The assays are pending inclusion into the Property report.

All aspects of the due diligence program were conducted with adherence to COVID-19 protocols for personal safety.

Figure 5. Large geochemical color anomaly at the El Cumbro target – Diamante 2

Geochemical Analysis, Quality Assurance and Quality Control

Due diligence samples were delivered to the ALS sample preparation facility in Hermosillo, Sonora, Mexico. ALS Global in North Vancouver, British Columbia, Canada, is a facility certified as ISO 9001:2008 and accredited to ISO/IEC 17025:2005 from the Standards Council of Canada.

The samples are crushed to 70% passing 2mm (PREP-31) and a split of up to 250 grams pulverized to 85% passing 75 micrometres (-200 mesh). The sample pulps and crushed splits are transferred internally to ALS Global's North Vancouver analytical facility for gold and multi-element analysis and, if required, to ALS in Reno, NV for hyperspectral analysis using the Terraspec 4 and aiSIRIS identification of the principal alteration minerals.

Figure 6. Geologist conducts due diligence at El Cazo - La Olla North artisanal workings - Diamante 1.

Pulps (50gram split) are submitted for analysis by Fire Assay with Atomic Absorption finish (ALS Code Au-AA24). The retained pulps also are analysed by Four Acid Digestion followed by Inductively Coupled Plasma Mass Spectrometry (ICP-MS) multi-element analyses (ALS Code ME-ICP61m). All gold and silver analyses that reached the over-limits are re-analyzed with an Ore Grade method. Over-limit Au and Ag samples are analyzed by Fire Assay with Gravimetric Finish Ore Grade (Au-GRA21 or Au-GRA22), and Aqua Regia Digestion followed by Ore Grade Inductively Coupled Plasma Atomic Emission Spectrometry (ICP-AES) for Ag (ALS Code Ag-OG46).

Given the small number of samples collected, in-house quality control samples (blanks, standards, preparation duplicates) were not inserted into the sample set. ALS Global conducts its own internal QA/QC program of blanks, standards and duplicates, and the results are provided with the Company sample certificates. The results of the ALS control samples are reviewed by the Company's QP and evaluated for acceptable tolerances. All sample and pulp rejects will be stored at ALS Global pending full review of the analytical data, and future selection of pulps for independent third-party check analyses, as requisite.

Qualified Person

Greg Davison, PGeo, Silver Spruce VP Exploration and Director, is the Company’s internal Qualified Person for the Diamante Project and is responsible for approval of the technical content of this press release within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101"), under TSX guidelines.

About Silver Spruce Resources Inc.

Silver Spruce Resources Inc. is a Canadian junior exploration company which has signed Definitive Agreements to acquire 100% of the Melchett Lake Zn-Au-Ag project in northern Ontario, and with Colibri Resource Corp. in Sonora, Mexico, to acquire 50% interest in Yaque Minerales S.A de C.V. holding the El Mezquite Au project, a drill-ready precious metal project, and 50% interest in Colibri’s early stage Jackie Au project, with both properties located only 12 and 6 kilometres west from Minera Alamos’s Nicho deposit, respectively. The Company also is pursuing exploration of the drill-ready and fully permitted Pino de Plata Ag project, located 15 kilometres west of Coeur Mining’s Palmarejo Mine, in western Chihuahua, Mexico. Silver Spruce Resources Inc. continues to investigate opportunities that Management has identified or that have been presented to the Company for consideration.

Contact:

Silver Spruce Resources Inc.

Greg Davison, PGeo, Vice-President Exploration and Director

(250) 521-0444

gdavison@silverspruceresources.com

Brian Penney, Chairman

(902) 430-8270

info@silverspruceresources.com

www.silverspruceresources.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Notice Regarding Forward-Looking Statements

This news release contains "forward-looking statements," Statements in this press release which are not purely historical are forward-looking statements and include any statements regarding beliefs, plans, expectations or intentions regarding the future, including but not limited to, statements regarding the private placement.

Actual results could differ from those projected in any forward-looking statements due to numerous factors. Such factors include, among others, the inherent uncertainties associated with mineral exploration and difficulties associated with obtaining financing on acceptable terms. We are not in control of metals prices and these could vary to make development uneconomic. These forward-looking statements are made as of the date of this news release, and we assume no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward-looking statements. Although we believe that the beliefs, plans, expectations and intentions contained in this press release are reasonable, there can be no assurance that such beliefs, plans, expectations or intentions will prove to be accurate.